V1 (deprecated)

Below is the original white paper of B.Protocol v1, released in June 2020.

B.Protocol — A Decentralized Backstop Liquidity Protocol

B.Protocol makes lending platforms more stable by incentivizing liquidity providers (keepers) to commit on liquidation of under collateralized loans and shift the miners extracted profits back to the users of the platform.

You can find this article also on Medium.

Introduction

Decentralized lending platforms, e.g., Compound, MakerDAO, Aave, and dYdX, are gaining wide popularity in recent years, but suffer from three major drawbacks:

1. Low yield on user deposits.

2. Lack of commitment from the liquidators who are responsible for the underlying security of the lending platform.

3. A big part of the lending protocol value is taken by the underlying blockchain miners due to gas wars between liquidators who “fight” for undertaking borrowers' under-collateralized loans.

In this post, we introduce B-Protocol, a decentralized backstop liquidity protocol, where backstop liquidity providers (BLP) buy their right to liquidate under-collateralized loans and share their profits with the users of the platform. As a result, the users (borrowers and lenders) receive additional yield to their usual interest rate. The proposed mechanism eliminates the need for gas wars between liquidators, and thus transfers a big part of the protocol value back to the borrowers and lenders, which in turn improves their effective interest rate.

In the next section, we bring the necessary background on how liquidations currently work over existing lending platforms like Compound and MakerDAO. In the subsequent section, we present how B-Protocol is built atop those existing platforms, and in the final section, we depict the advantages of our approach to users, liquidators, and the platforms.

DeFi Lending Platforms and Liquidations

Users interact with lending platforms by supplying (depositing) collaterals and borrowing (withdrawing) assets to and from the platform. A user account is undercollateralized if his total loan exceeds his total collateral (multiplied by an asset-specific collateral factor). Once an account is undercollateralized, a liquidation process is done by giving the liquidator the borrower’s collateral at a discount price, and the liquidator will be the first Ethereum account to call a liquidation function in the platform’s smart contract.

This approach gives rise to gas price wars where Ethereum accounts compete on who will give the highest gas price for the liquidation transaction, in order to get higher priority among miners who decide the order of transactions.

As a result, great value is shifted away from the platform users (i.e., borrowers and lenders) to the Ethereum miners, and to blockchain developers who craft sophisticated optimizations to increase the likelihood of winning and reduce the cost of a loss.

These gas wars add another layer of cost uncertainty for the liquidators, one that they are not used to when they are doing liquidations on centralized platforms like Kraken and FTX

Ori Cohen has 20 years of algo-trading experience in the traditional markets, now Head of Research @ Efficient Frontier which is a leading technology and research company facilitating digital asset trading and powering billions in annual trade. He says -

For decades quants have learned how to estimate the likelihood of defaults, however, gas wars and elusive network topology make it impossible for me to model the liquidation success ratio over DeFi platforms. This uncertainty might deter big players from providing liquidity for lending platforms.

This deters even experienced DeFi players from building liquidation systems, despite the fact that most of their capital is already kept on-chain.

Gas Wars are killing the LPs, B-Protocol is a much-needed protocol.”

Spyros Vretos, Head of Trading at Kyber Network, the leading liquidity provider protocol in the Ethereum (DeFi) ecosystem.

Decentralized Backstop Protocol

The B-Protocol is a protocol where liquidators share their profits with the users of the platform in return to a franchise which gives a priority in the liquidation process. A periodic auction process is being done to determine the franchise winners. Where during the auction liquidators bid on the percentage of profit sharing. These profits go to a jar which is periodically distributed to users according to their rating.

It is our belief that for the long run liquidators will be willing to pay more than just the expenses they currently have on gas wars, since the certainty of the franchise would lower their desired minimum profit on liquidations.

The difficulty in mathematically modeling transaction ordering outcomes adds a layer of model uncertainty for competing liquidators, contributing an extra risk spread to on-chain liquidation premia, in addition to the MEV (Miner extractable value) spread due to the cost of the gas auctions themselves. Lev Livnev, founding partner of Symbolic Capital Partners

As a result, not only most of the miner’s profits are routed back to the users, but also the underlying lending platforms enjoy a bigger commitment from the winners of the auction, and thus get better protection when extreme market conditions occur.

Backstop certainty will allow me to better organize, manage and allocate more funds towards future liquidations and as a result utilize my inventory much more efficiently. Spyros Vretos, Head of Trading at Kyber Network

We integrate B-Protocol with existing lending platforms by letting the users interact with the lending platforms via a dedicated smart contract interface. And B-Protocol liquidators get a priority in the liquidation process by providing a cushion to the user account when it is getting close to the liquidation price.

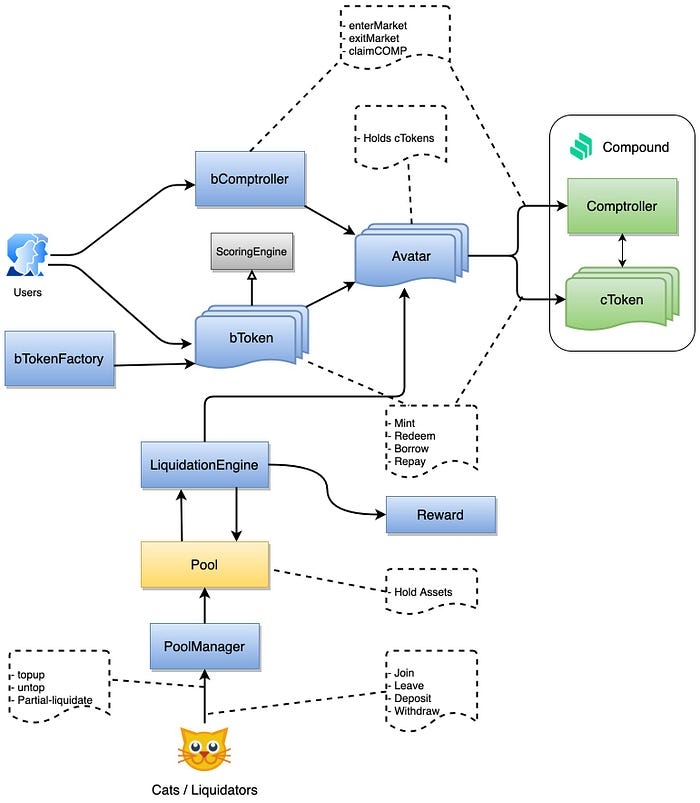

The below diagram shows how B-Protocol is built atop Compound. The protocol API to end-user is identical to Compound’s API, and the only difference is that the users are interacting with different addresses. Liquidators provide the cushion with a top-up operation, and a scoring engine updates the user rating whenever he performs an operation. The user rewards are kept in a Jar that is distributed according to the user rating.

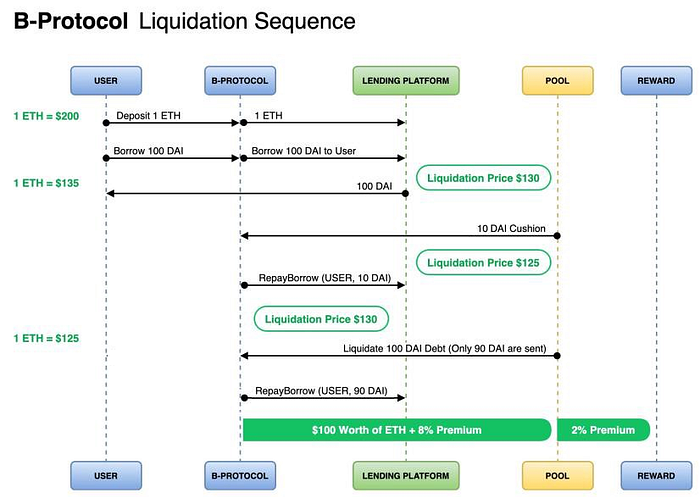

The next diagram depicts an interaction between the user, the underlying lending platform, and the liquidators. In the described scenario user borrows 100 DAI when ETH price is $200, and as the price goes down, the liquidity provider (LP) provides a cushion to the user debt. Finally, when the price of ETH hits the liquidation price, the LP liquidates the user on B-Protocol smart contracts and share the profit with the Jar (which later will share it with the users of the platform).

Conclusion

B-Protocol gives better security guarantees to its underlying lending platforms, better yield to its users, and higher income to its liquidity providers. All without changing anything in the underlying lending platforms. This is achieved by a design choice to shift the arbitration power on who will be the liquidator, from the miners to a smart contract that implements a crypto-economic mechanism, to decide who is the best fit to hold the liquidation franchise. Shifting the decision from miners to a smart contract eliminates the liquidators gas war costs, and gives them much more certainty. Which in turn allows the liquidators to share some of their profits with the users, and make the lending platforms more secure, as the liquidators are now more committed.

We currently build B-Protocol around the three leading lending platforms, namely, Compound, Makerdao, and Aave. In the future, our system will have a standard abstracted layer that will allow seamless integration with all lending platforms.

Website: https://bprotocol.org

Last updated

Was this helpful?