Liquity User Guide

A step-by-step guide for users on the B.Protocol-Liquity integration

B.Protocol v2 has launched its first integration on top of Liquity to enable automatic rebalancing of users’ positions in Liquity Stability Pool once liquidations are taking place.

This means that once a Liquity Trove is being liquidated and its ETH is being seized in return for paying its debt with LUSD from the Stability Pool, the seized ETH will be automatically sold back into LUSD, using B.AMM (the Backstop AMM which is the core unit of B.Protocol v2).

Though B.Protocol is using the same UI Liquity has across most of its different frontends, this step-by-step guide will walk you through the main steps of how to use this integration in case this is your first time using Liquity. Please pay attention that in B.Protocol there is no option to open a Trove (e.g. deposit ETH and mint LUSD), and the work assumption here is that users already have obtained LUSD and are looking to deposit it into the Stability Pool.

First step would be to connect MetaMask to the Liquity app integration on B.Protocol — https://app.bprotocol.org/liquity

Make sure to connect with the same account where you keep your LUSD.

Once your MetaMask is connected you can Deposit LUSD into Liquity Stability Pool. B.Protocol pools users funds so you can see how much of Liquity’s pool is managed by B.Protocol on the left box (32.9m LUSD, which are 6.9% of Liquity’s pool at the time of writing).

You can also see the current LQTY APR, which is the reward token distributed by the Liquity protocol for users who deposit LUSD in the Stability Pool. It’s worth mentioning that B.Protocol does not take any cut of the LQTY rewards, which means users get 100% kickback rate for their deposits.

You would need to confirm the transaction on MetaMask

Unlike in other frontends for Liquity, in B.Protocol you would need to Unlock your LUSD on MetaMask before you can deposit into the stability pool. This is not different than any of the “regular” allowance users need to give to new tokens on Compound, Uniswap etc. Once you unlock on MetaMask, you will be able to deposit your LUSD. You can use the MAX button to deposit all of your current LUSD balance.

Withdrawing is made by Adjusting your LUSD deposit amount

If you want to Withdraw your LUSD from the Stability Pool, you need to Adjust your current deposit, stating how much you want to have in the pool. So to withdraw 100% of your LUSD you would need to adjust your deposit to 0 LUSD. The tool tip at the bottom of the box will show you how much you are withdrawing and what impact it has on your share in the stability pool. Withdrawing will also automatically claim your LQTY rewards.

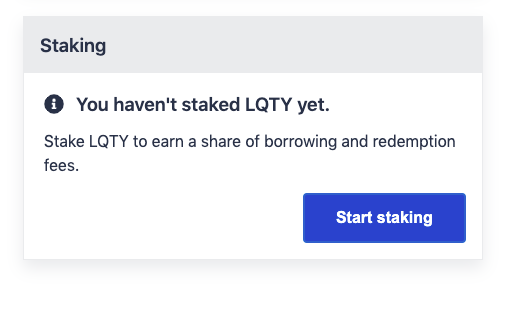

Stake your LQTY for more rewards

Users can stake their LQTY in order to get their share in Liquity’s protocol fees. Staking your LQTY is the same as in any other Liquity frontend and doesn’t include any B.Protocol wrapper around it (like it’s done in the LUSD deposits).

You can read more about Liquity Stability Pool in their docs — https://docs.liquity.org/faq/stability-pool-and-liquidations.

Watch the live call the B.Protocol team had with the Liquity team after the launch, where there is also a short demo of the integration —

Last updated

Was this helpful?