Mitigating The Human Factor in DeFi Risk Management

Intro

DeFi ethos is all about code-is-law with neutral, self-executing applications that run on the blockchain without human intervention, from DEXs to Bridges to options trading, and more. The only exception is DeFi lending markets. In lending markets, the core activity to maintain a market active and safe is by setting and adjusting its risk parameters — an activity that is still run manually by DAO votes.

Setting the right risk parameters, such as collateral factors (Loan To Value, LTV), liquidation thresholds, interest curves, etc., are governance-heavy as each adjustment requires token holders to vote based on forum discussions and recommendations of risk management teams.

There are a few issues with these manual decision-making processes -

They take time — and as the pace of crypto market dynamics is high, sometimes the decisions are time-sensitive, and governance and time-locks may expose the platform users to unintended excessive risk.

They are exposed to human bias — as some decisions may affect some token holders more than others, and as not many have the required knowledge and skills to analyze each recommendation, there is a risk of the decision-making being manipulated through influencers who have a stake in the results.

They are not self-executed — As humans are in charge of the execution, there is a risk of not executing a required decision due to politics within the governance of the protocol.

In this post, we will focus on how Risk Oracle can minimize human intervention and the politicizing of DeFi lending platforms’ risk management decision-making processes. Aligned with DeFi’s un-written ethos, an automated, self-executing smart contract can make sure the red button will be pushed when needed, as it was intended and pre-approved by the governance of the protocol.

Manual Decision-Making

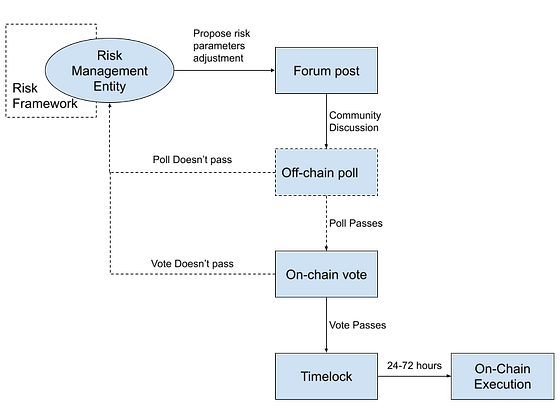

Today, lending platforms manage their economic risk manually. For those less familiar with how these systems operate here’s a simplified flow of risk management decision-making in platforms managed by a DAO -

These processes take time and require high participation in governance activity. Time is not always something lending platforms can afford when it comes to adjusting risk parameters as crypto market conditions change rapidly. As for governance participation, this may also be a barrier as many DAOs find it hard to reach the required quorum to pass votes (which sometimes results in a second vote, which adds to the time-sensitive issue).

Politicized Risk Management

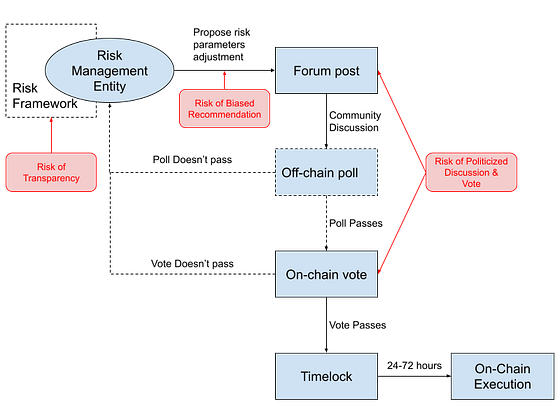

We have discussed in a previous post the problems of time-sensitive risk-related decisions to be taken under such a process and the way Risk Oracle can mitigate this risk with an automatic process. But besides time constraints there is the issue of human intervention and politics in the process.

Many factors can impact the risk exposure of users, and different user profiles can be impacted by risk adjustments in different ways according to their specific positions and assets. This situation makes the decision-making process political in nature, where the risk managers can prioritize different factors that will lead to different recommendations according to their perception of risk impacts.

We term this a “Politically Biased Risk Management” and believe an automated, decentralized, smart contract-based solution such as Risk Oracle can mitigate and eventually prevent this risk altogether, aligning the process with the neutral, self-executing ethos of DeFi.

The Trading System Comparison

In a similar way to DeFi lending risk management, a high-pressure trading environment where rapid decisions must be made, there can be a risk that political pressures or other external factors may lead traders to deviate at the last minute from the established trading plan, even if they are fully committed to executing it.

To address this issue, some hedge funds and trading firms have implemented automated trading systems that can help ensure consistent and disciplined execution of trading strategies. These systems can be programmed to follow specific rules and guidelines and to automatically execute trades based on predefined criteria in market conditions.

These automated trading systems help remove the emotional and political pressures that can sometimes interfere with manual trading and can help ensure that trades are executed consistently and according to the trading plan. They can also be backtested and optimized to improve their performance over time and can help traders make rapid decisions in volatile markets.

This automated “Politics-proof” system is also required with risk management in DeFi where market conditions can change rapidly, and the DAO decisions can be influenced by internal or external politics. Without a self-executing layer to adjust risk parameters, platforms can be exposed to excessive risk, beyond the pre-defined risk levels that were approved by the DAO as the rulebook.

DeFi Lending Risk Management Politics

The term “politics” might require a bit of explanation in the context of DeFi risk management. DAOs are prone to internal politics, maybe even more than other organizational structures. Most DAOs have a relatively small amount of token holders or delegates who are active and knowledgeable enough to keep track of the required steps for proper risk management. The ability of large players to influence decision-making that might benefit some, while exposing others to risk is an ongoing reality.

For example, whales or VCs who hold a significant amount of a specific token can try to influence the decision-making process of listing assets as collaterals in lending markets or push for higher LTV, in order to maximize their leverage capabilities on their initial investment. As long as the risk management process is not transparent and automated, these processes might be influenced by the identity of the entity submitting the governance proposal.

Risk Oracle — Unleashing Non-Politicized Risk Management

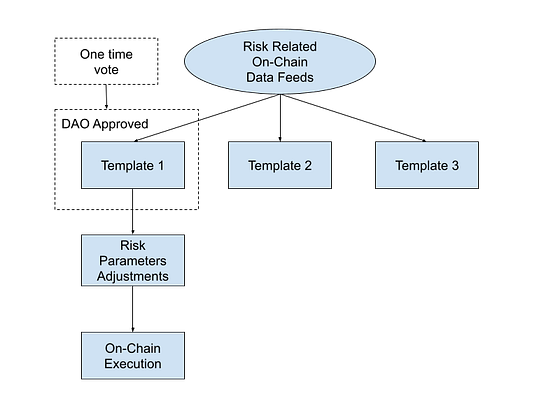

Though risk-related market data such as liquidity and volatility of assets, is available on-chain, there are still no standards for how they should be collected or calculated. Even after the data is collected, there is still a need for a transparent risk framework, e.g. Templates, that “crunch” the raw data and calculate the risk parameters (CF, LT, etc) according to specific assumptions and algorithms. Once such Templates exist, platforms could choose a ready-made template, or build their own templates for listing asset requirements, adjusting risk parameters, and more according to their risk appetite and other considerations the protocol might have. The DAO that governs the protocol can then pre-approve the template that will dictate the right risk parameters according to the market data.

Risk Oracle’s first version will publish on-chain raw risk feeds that will include assets’ liquidity and volatility. Community members and devs could then use this on-chain risk data in their risk templates to calculate relevant risk parameters for lending markets. The template can enable automatic adjustments of the risk parameters according to the risk oracle feeds.

By approving a risk framework template, a DAO will not only enable the automation of the process, but will also dictate a single rulebook for listing assets, setting collateral factors, adjusting parameters in an ongoing and gradual manner according to changes in market conditions, and much more.

Challenges

Of course, automated systems are not a panacea, and they can also be subject to technical glitches, errors in programming, or other issues that can lead to unintended outcomes. It’s also important for risk managers, DAOs, and community members to continuously monitor and evaluate their automated systems to ensure that they are functioning as intended and to adjust them as needed based on changing market conditions or other factors.

To mitigate this risk, a gradual onboarding process is required, where tools like Risk Oracle start with more narrow capabilities, e.g. publishing recommendations for the risk management teams to approve before execution. With time and as the system demonstrates its capabilities, it can be embedded directly into the smart contracts that set and adjust risk parameters as well as the assets’ listing process itself.

Conclusion

The risk management process today in DeFi is manual and as such is prone to be influenced by internal or external politics. Risk Oracle paves the road for a transparent risk management rulebook with a self-executing layer that can enforce risk parameters adjustment in an automated way as was pre-approved by the DAO. Lending platforms can start the transition in a gradual way, setting the edge cases that require manual intervention in the process.

Last updated

Was this helpful?