Compound User Guide

This is a step-by-step tutorial on how to Import your Compound account into B.Protocol, as well as how to open and use a new account.

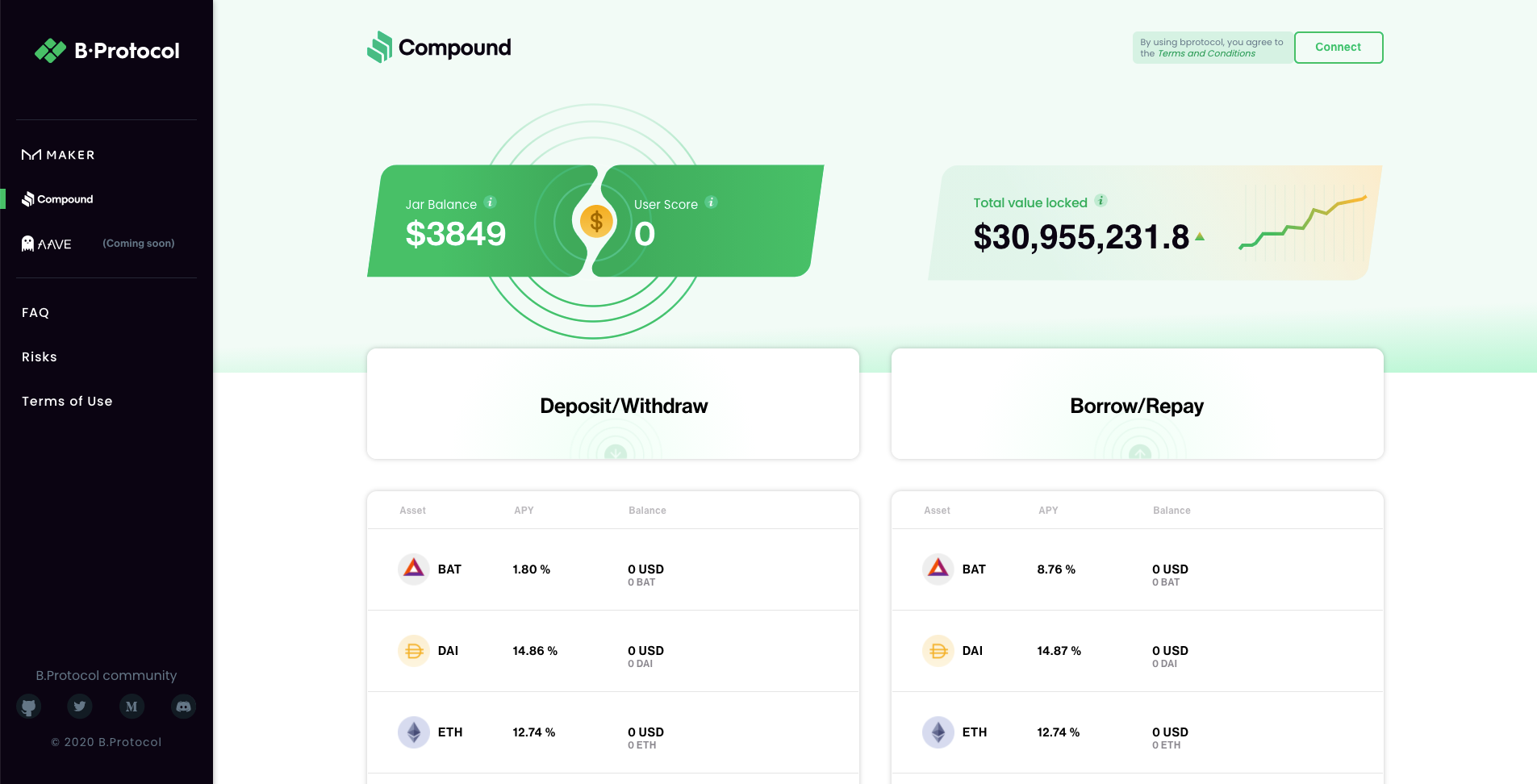

Connect

Head over to https://app.bprotocol.org/compound and make sure your MetaMask is connected. Click the “Connect” button on the top right corner of the B.protocol app to connect your MetaMask account to B.Protocol. If you already have an account on Compound, make sure to connect your MetaMask with the same account used for Compound in order to be able to use the Import widget.

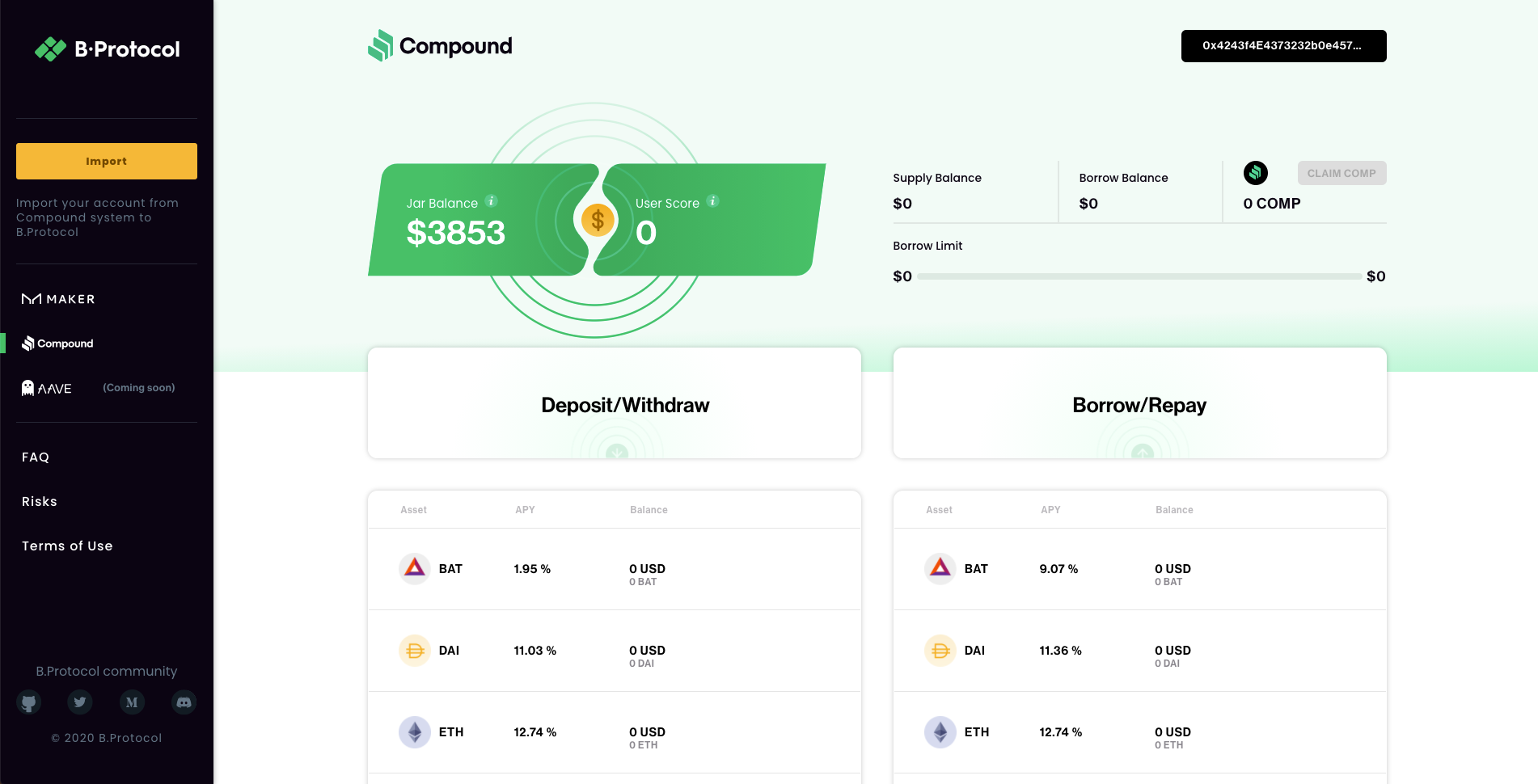

Import

Once you have connected your MetaMask on B.Protocol, if you have a Compound account connected to the same MetaMask account, you will see an “Import” button on the top left corner.

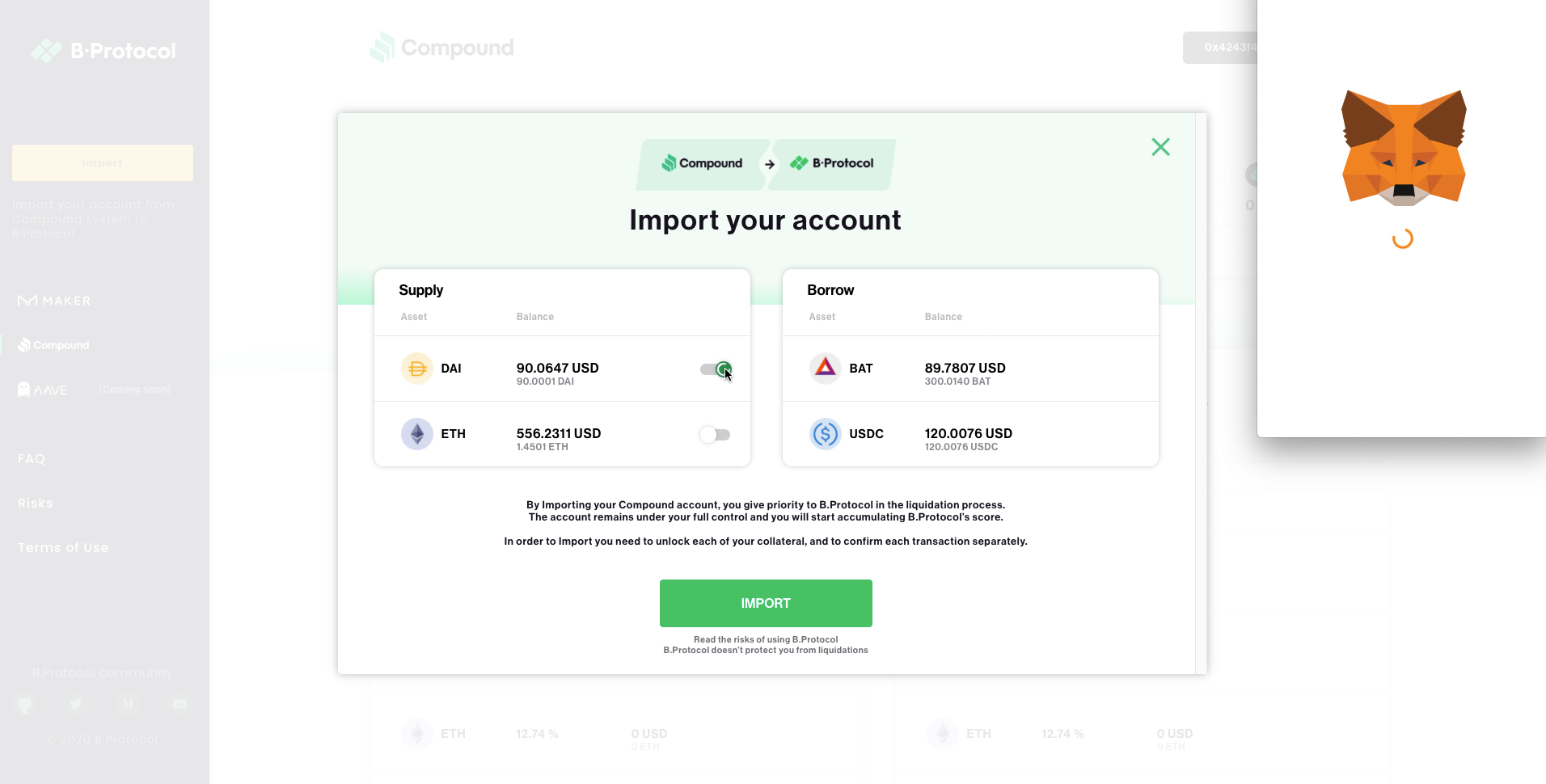

Once you click the Import button, a widget will open where you will be able to see your deposits and borrowing balances on the Compound account to be imported. You will have to Unlock each of the supplied tokens separately (using the radio button next to each token) and Confirm it on MetaMask before the Import transaction could be made. The Import operation itself is a single Ethereum transaction and could take up to a few minutes, depending on gas and network congestion. Your $COMP balance will be imported as well of course.

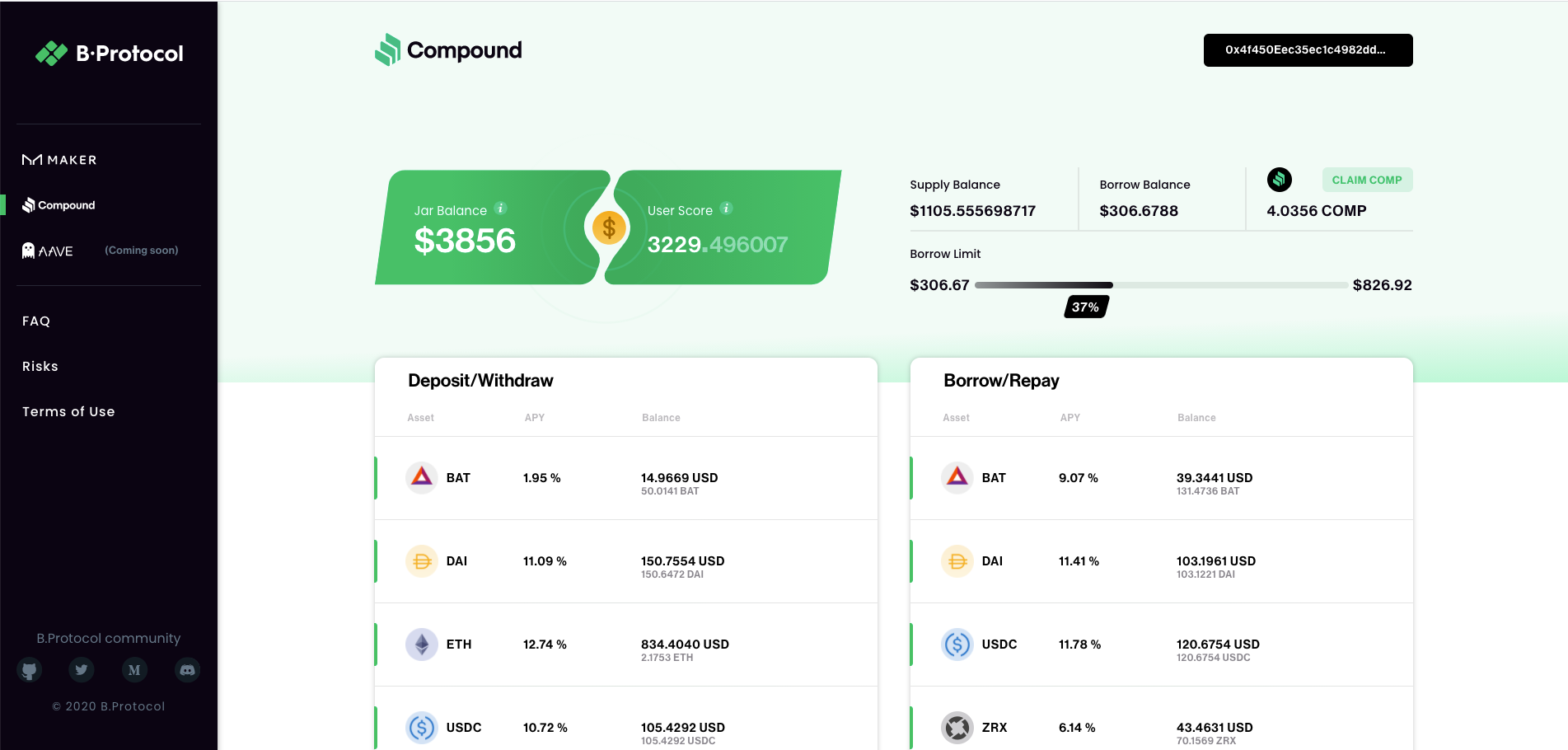

Once imported, your account on app.compound.finance will show zero balance, but you will be able to see your balance, Deposit/ Withdraw, as well as Borrow/ Repay any of the tokens available on Compound, as well as claim your COMP via your B.Protocol account.

Using B.Protocol will give you the exact same conditions as using Compound directly (same APYs, collateral factors, liquidation penalty, COMP distribution rate, etc.), PLUS you will start gaining cScore — the B.Protocol score for Compound integration. Your cScore will determine your part in the Liquidation cJar. According to B.Protocol governance decisions and the current Liquidity Mining program, users might be entitled for $BPRO rewards, the B.Protocol governance token. Users can follow the status of these on the forum or on Discord

New Compound Users

In case you don’t have an account on Compound, or prefer opening a new account via B.Protocol, you can supply token(s) and get interest rates on them. Once you have deposited a token as collateral, you can also borrow tokens from the list and use them for whatever purpose you want. Borrowing will accrue borrowing interest fees you will have to pay once Repaying your loan. Interest rates (APY) are the same as on Compound, both for Supplied and for Borrowed tokens.

You will find that all actions on Compound are the same on B.Protocol (only with a more stunning and convenient UI if we may say…).

Deposit and Borrow

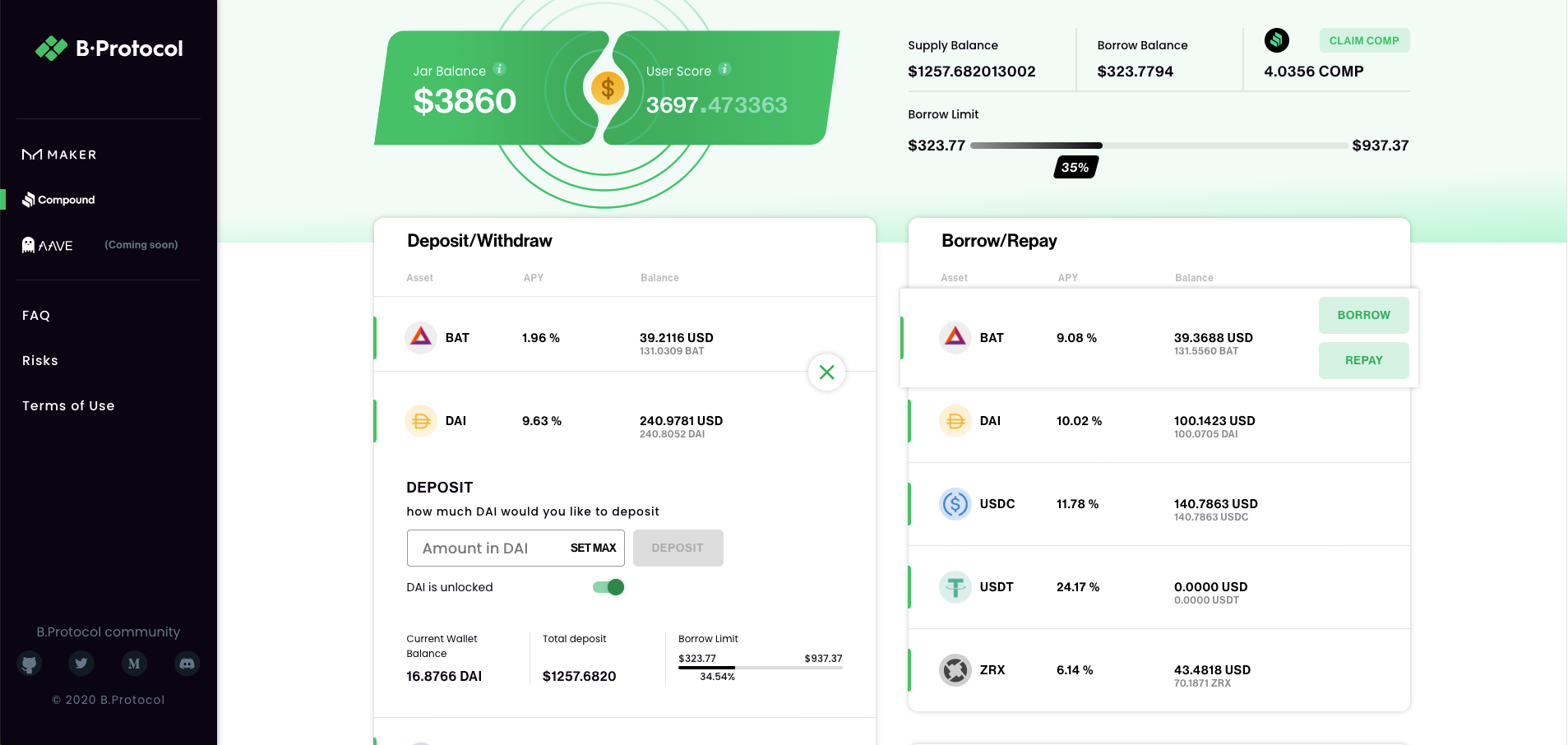

In order to borrow a token, you first need to Deposit some collateral. Depositing a new token will demand first to Unlock it (and confirm it on MetaMask). Once the token you want to deposit is unlocked you can enter the amount you would like to Deposit. Using SET MAX will deposit the current balance you hold in your wallet of this specific token into your account. For the deposit to happen you need to confirm the transaction on MetaMask.

Once you have deposited one (or more) tokens as collateral, your Borrow Limit will show you how much you can borrow in USD values according to the Collateral Factor of each asset as it was set by Compound (https://compound.finance/markets). For example, after depositing 1000 DAI you can borrow up to $750 worth of DAI or other tokens, as the CF of DAI is 75% on Compound currently.

In each action box (Deposit/Withdraw/Borrow/Reapy) you can see some data to help you make better decisions. This data currently includes, for each token — APY%, Balance in your account, Balance in your MetaMask wallet, the Total Deposit in your account, and a bar that shows your Borrow Limit (according to your total deposits and their collateral factors) and how much of it is currently used (in USD values).

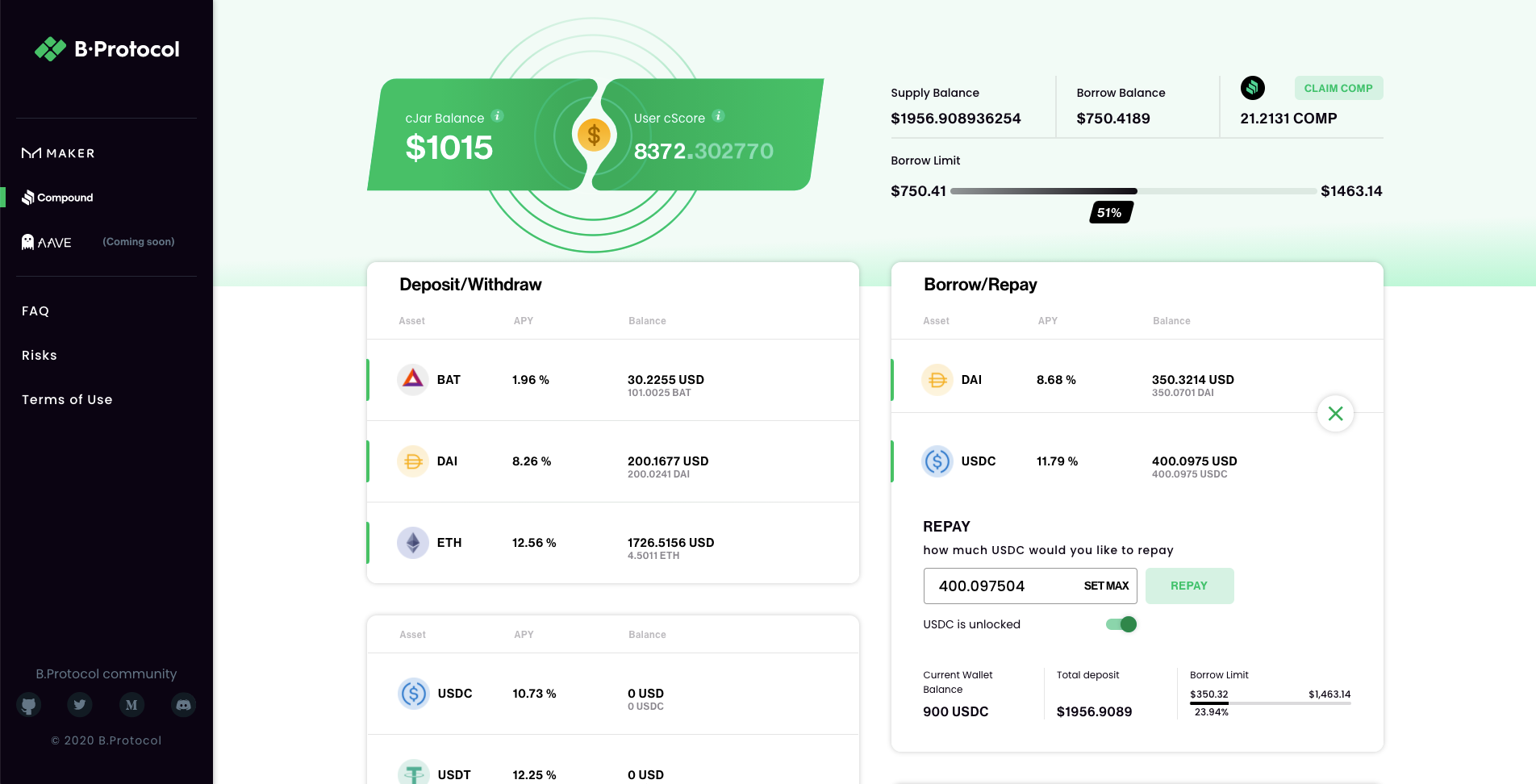

Repay and Withdraw

When you want to repay your loan you can do that by clicking the Repay button next to the token you would like to pay back. You will need to Unlock the token and confirm it on MetaMask if you haven’t done so already. You can use the SET MAX option to repay your full debt, but it may prompt an alert if you don’t have sufficient balance in your wallet to close your loan as you would have to cover the interest you have accrued.

When you want to Withdraw the collateral you have supplied, the app will let you do that as long as you are not causing your account to become unsafe, e.g. crossing your borrowing limit to a level that your account can be liquidated (having more debt than the collateral you have, as calculated by the CF). A notification will pop up in such a case.

COMP Rewards

B.Protocol users are eligible for $COMP rewards just like if they would interact directly with Compound. Your COMP will be shown at the top of the B.Protocol app and you can claim it by clicking the Claim COMP button and confirming the transaction on MetaMask. The COMP will be transferred to your MetaMask wallet.

You can learn more about Compound and the distribution of COMP from the platform’s documents here — https://compound.finance/docs

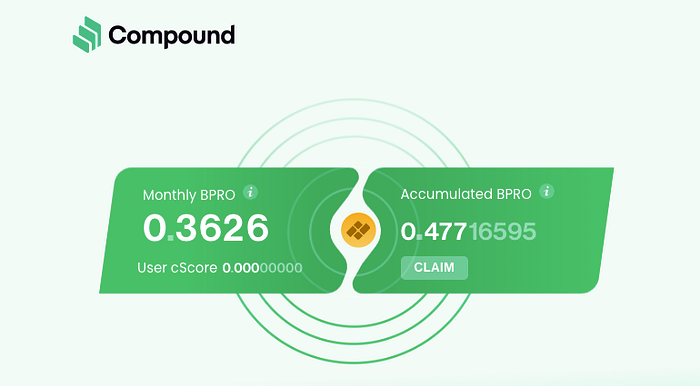

BPRO — B.Protocol governance token

Users of B.Protocol-Compound might be eligible for BPRO rewards according to DAO decisions which are made periodically. You can follow these over the forum or on Discord.

cScore — Your B.Protocol User Score

As long as you supply a token or have an open loan, e.g. borrowed tokens, on the B.Protocol app, you will be accumulating B.Protocol-Compound User Score — cScore. A user cScore determines his/her part in the cJar.

The cJar holds the users’ share of the liquidations made by the Backstop on Compound (for those using B.Protocol). The Backstop liquidators transfer 3% out of the 8% discount they get on each liquidation into the cJar.

For any further support, or if you just want to jump into the on-going discussion, please join the B.Protocol Discord — https://discord.gg/bJ4guuw.

Last updated

Was this helpful?